Getting your project idea funded may be extremely complex, as investors would like to support startups with outsourcing concepts. Therefore, it’s vitally important to present your project as well as dive deeper into the advantages and disadvantages of funding sources.

This article will define how to receive the funding for app development, the main steps of this process, great business financing resources, and much other useful information concerning this topic.

Startups Funding

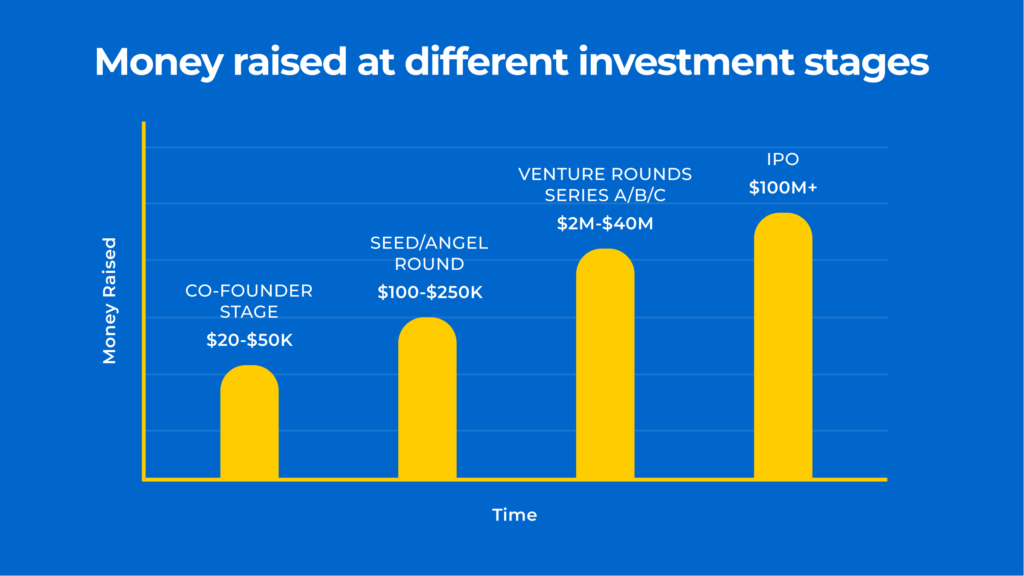

To present the app concept and why it is worth making investments, you’ll have to fulfill funding rounds (3 months- 1 year each) aimed at gathering sufficient investments as well as progressing the project.

Here are the fundamental phases to go through for funding obtaining:

Pre-seed stage

Project owners describe the outstanding idea for the product and start it using their own investments.

Seed stage

This stage refers to engaging alleged angel investors covering the moderate business-related spendings, such as plan outlining, specialists employment, rent fees, etc.

Series A

During this phase, third-party investors are involved. Commonly, founders present the project progress from previous funding rounds to venture capital organizations.

Series B

This stage is connected with tech projects, progressing them into companies. The solidity and value of the startup are proven, so now, founders concentrate on embracing more clients as well as the market.

IPO

The initial public offering (IPO) stage implies selling a private enterprise’s assets to the public. It ensures great funding options and brings higher clearance.

Funding Sources for Tech Startups

Let’s list the most popular financial sources to be aware of:

- Crowdfunding. Gathering investments via certain platforms, such as Kickstarter or Indiegogo, prior to the software development. You may accomplish the project faster, yet, your concept may be stolen.

- Business incubators. Ensuring seed capital, arranging meetings as well as holding lectures concerning business insights for founders of startups.

- Bank loans. Selecting the option among a row of loans. The main drawback is dealing with documentation and complying with certain standards.

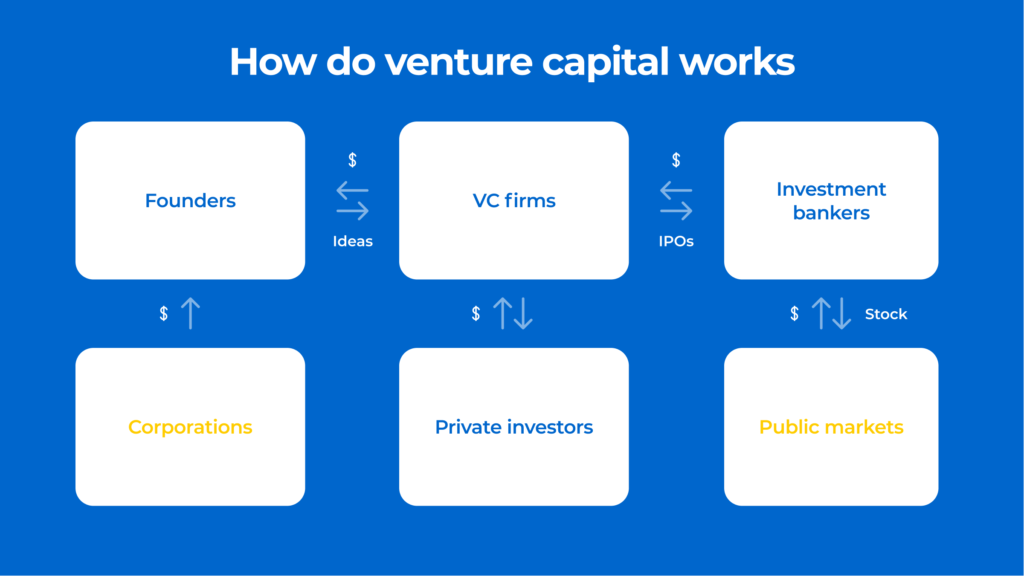

- Venture capital. Collective funding from the group of entities invested finances to the project.

- Angel investors. Investing in various kinds of projects, considering their potential, market, and user demand for the product, solidity, and originality.

Within the frameworks of modernity, capital and angel funding options are the most widely-applied ones. Let’s consider their principles and peculiarities more precisely.

What Is Venture Capital

This type of capitalists help projects that are willing to restructure the market and have rapid progress. The VC organization assesses the project idea and assesses if it’s worth investing. After the funding, the VC entity waits for the progress of the company for further equity stake selling.

Why is cooperation with venture capital advantageous?

- Professionalism and experience of venture capital team

- Networking expansion provided by VC

- Higher trustworthiness established from the initial project stage

- Enhanced risks assessment and management

- In-depth due diligence of the VC experts

Who Are Angel Investors

Such individuals are those who would like to invest in your startups and may assemble a group to fund as a syndicate. Angel investors primarily lean on their own finances, so their investment sum isn’t extremely high.

Due to the fact that both covered earlier options are both popular, let’s compare them to understand which one is more profitable. Here are their main diverse features:

- Investment sum. VC organizations can provide bigger sums.

- Return on investments. The ROI is more expected and higher in the case with the VC.

- Due diligence. Once again, the VC offers more experience and professionalism in this aspect due to the fiduciary responsibility.

- Project participation. In contrast with angel capitalists who would like to possess the project entirely, VC firms request the board of directors to ensure the seat on it.

Angel Investments: Pros and Cons

At first sight, this option may seem slightly controversial, so here are its main advantages and disadvantages:

Pros:

- Decreased risks rather than taking with loans

- Higher engagement into the project

- Better obstacles prediction based on the previous experience

Cons:

- Frequent project quitting

- Obscure startups estimates

- Requesting huge project share

Minimum Viable Product Creation

An MVP version of your software comprises the essential functionality required to use it. To receive funding for this version, you should show an interactive prototype of your solution to the investors so they are able to take a look at the expected final result. MVP version allows rapid software architecture as well as launching, feedback assembling, and investment receiving for further solution advancement.

Here are the fundamental steps to complete to build MVP:

- Complete the market research to assess the idea’s relevance

- Get a clear idea of how your project concept will overcome the issues of the audience

- Define the product functionality which will satisfy users

- Select a credible software development vendor to bring all your ideas to reality

The development stage involves the following phases:

- Discovery. The stage is completed by Business Analysts who gather all the details concerning the project in one document called “specifications.”

- UI/UX design. It refers to building a clickable prototype of the product comprising interface elements layout.

- Architecture. The implementation of the features planned earlier to make the mockup function.

- Quality Assurance. Testing the product to detect possible bugs and get rid of them.

- Deployment. Making the software accessible for the first users.

After that, you should gather feedback from your first users to analyze it and enhance the product.

Startup Investment Estimation

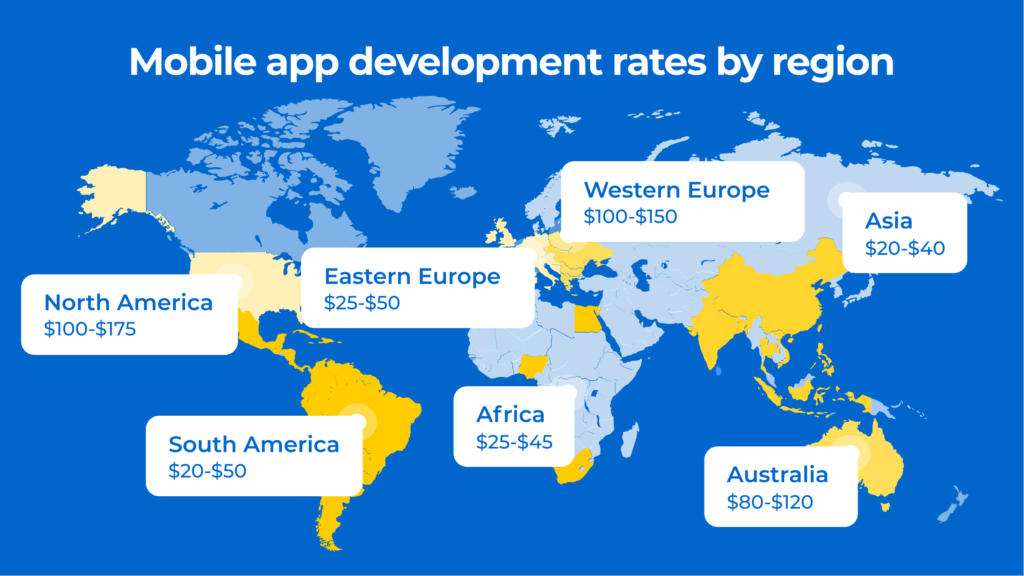

To calculate the startup final investment sum, you should consider the main cost determining factors, which are the following:

- Platform defining. The OS you create the software for

- Functionality. The features’ complexity

- Software developers’ rates. Tech-savvy experts’ location and hourly rates

The following pic indicates the hourly rates in various regions:

Summarize

If the idea is outstanding, the concept is easy-to-use, and can help to overcome the challenges of users, investors will eagerly help you to complete your project. Yet, please, remember that the final product quality depends on the chosen software development company, the teammates’ experience, professionalism, and technologies they use. Thus, you should select only certified and competent software architectures for cooperation.

My name is Katherine Orekhova and I am a technical writer at Cleveroad – mobile app development company. I’m keen on technology and innovations. My passion is to tell people about the latest tech trends in the world of IT.